Although the recovery during Obama's second term in office was one of the most anemic in U.S. history, 2slugbait's conclusion was that a supply-side effort would not have produced an enduring benefit.

Voodoo economics not so great

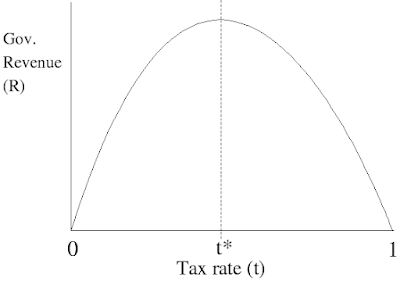

Economist Arthur Laffer was known for his Laffer curve. Laffer's recommendations about supply-side measures (rather than demand-side economic stimulus) were referred to as voodoo economics by detractors, most famously by former President George H.W. Bush.

2slugbait demonstrates empirically why supply-side economics was only

mildly effective. Specifically, neither of the following worked out the way supply-side economists posited at the time:

- cutting the top marginal tax rate would encourage greater labor efforts and

- more hours worked would have a greater net impact on increased personal savings than increased consumer spending would.

|

| The (infamous?) Laffer curve |

Skepticism about David Stockman and Laffer's tax policy recommendations

during the Reagan Administration is the less interesting part to me. Tax cuts for middle-income wage earners (not

solely those high net worth "job creators" 😕😡 ) CAN provide a modicum of economic stimulus, even though it is not enduring! That was apparent from

2017 to March 2019, as well as the early 1980s.

Something else is much more interesting to me: The long-term decline in Real Potential GDP. 2slugbait noticed this too in his post.

Real Potential Gross Domestic Product

According to 2slugbait,

"If the Reagan tax cuts actually affected the supply side of the macro economy... then we should have observed an unparalleled increase in the growth rate of real potential GDP...

Yes, real potential GDP did grow at a pretty good clip immediately after the Reagan recession, but it quickly faded... even at its peak it was only barely above the growth rates during the Nixon, Ford, and Carter years and well below rates enjoyed during the LBJ and Clinton years."

Real potential GDP (let's refer to it for convenience in this post as RPGDP) is defined in the Federal Reserve Economic Data repository (FRED) as